Get the free w7 form

Show details

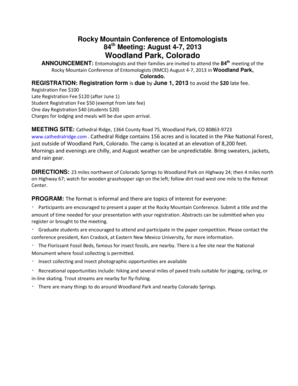

Form (Rev. January 2007) Department of the Treasury Internal Revenue Service W-7 Application for IRS Individual Taxpayer Identification Number See instructions. For use by individuals who are not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w7 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w7 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w7 form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sample filled w7 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

How to fill out w7 form

How to fill out w7 form sample?

01

Start by downloading the W-7 form from the official website of the Internal Revenue Service (IRS).

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Fill in your personal information, including your name, address, and social security number.

04

Determine your purpose for requesting an Individual Taxpayer Identification Number (ITIN) and provide a detailed explanation in the appropriate section.

05

If you are applying for an ITIN due to being a nonresident alien required to file a U.S. tax return, attach the tax return to the W-7 form.

06

Gather the necessary supporting documentation, such as a valid passport, birth certificate, or visa, to prove your identity and foreign status.

07

Attach the required documentation to the completed W-7 form. Be sure to make copies for your records.

08

Review your form and attached documents to ensure accuracy and completeness.

09

Sign and date the form in the designated areas.

10

Mail the completed W-7 form, along with the supporting documents, to the address provided in the instructions.

Who needs w7 form sample?

01

Individuals who are not eligible for a Social Security Number (SSN) but need to fulfill their tax obligations in the United States.

02

Nonresident aliens who are required to file a U.S. tax return.

03

Spouses or dependents of individuals who are not eligible for an SSN but need to be claimed for tax purposes.

04

Foreign individuals who need an ITIN to open a U.S. bank account or apply for certain government benefits.

05

Students or scholars who require an ITIN for educational purposes or to apply for a scholarship or grant.

06

Nonresident aliens who are conducting business or investing in the United States.

07

Some individuals who are not eligible for a SSN but are eligible for certain tax treaty benefits.

Please note that the specific requirements and eligibility criteria for obtaining an ITIN may vary. It is always recommended to consult the latest guidelines provided by the IRS or seek professional assistance when completing the W-7 form.

Fill how to fill out a w7 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is w7 form sample?

The W-7 form is not applicable to samples. The W-7 form, also known as the Application for IRS Individual Taxpayer Identification Number, is used by individuals who are not eligible to obtain a Social Security number but still need to report income and pay taxes in the United States. It is used to apply for an Individual Taxpayer Identification Number (ITIN). A sample of this form can be obtained from the Internal Revenue Service (IRS) website or through tax preparation services.

Who is required to file w7 form sample?

The W-7 form is required to be filed by non-US citizens or resident aliens who are not eligible for a Social Security Number (SSN) but need to obtain an Individual Taxpayer Identification Number (ITIN) for tax purposes. This form is typically used by individuals who earn income in the United States or have US tax obligations but do not qualify for an SSN.

How to fill out w7 form sample?

Filling out the W-7 form can be done by following these steps:

1. Obtain the W-7 form: You can find a sample of the W-7 form on the official Internal Revenue Service (IRS) website or obtain a physical copy from an IRS office.

2. Provide your personal information: In the first section of the form, you need to enter your full name, mailing address, date of birth, and country of birth. Make sure to provide accurate and up-to-date information.

3. Indicate your tax identification number (TIN) requirement: In this section, you will need to select the reason for needing a TIN. The options include needing a TIN for filing a U.S. federal tax return, being a foreign individual subject to U.S. withholding, or being a nonresident alien required to get a TIN to claim an exemption.

4. Provide supporting documentation: Attach the necessary supporting documentation depending on your reason for needing a TIN. This could include a fully certified foreign status tax return, a U.S. federal tax return, or an exemption document issued by the IRS or another government agency.

5. Fill out the requested information: Depending on the selected reason for needing a TIN, you will need to complete the corresponding sections of the form. This could include entering your foreign tax identification number, U.S. visa type, passport details, or other required information.

6. Provide a signed declaration: At the end of the form, you need to sign and date the declaration verifying that the information you provided is true, correct, and complete to the best of your knowledge.

7. Submit the form: Once you have completed the form and attached the necessary supporting documents, you can submit it either in person at an IRS office or by mail to the address provided on the form or on the IRS website.

It is important to note that the W-7 form is used specifically for obtaining an individual taxpayer identification number (ITIN) from the IRS, which is used for tax purposes by individuals who are not eligible for a Social Security number.

What is the purpose of w7 form sample?

The W-7 form sample is used to apply for an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS) in the United States. An ITIN is issued to individuals who are required to have a U.S. taxpayer identification number but are not eligible for a Social Security Number. The W-7 form is used to provide the necessary information and documentation to establish eligibility for an ITIN.

What information must be reported on w7 form sample?

On a W-7 form sample, the following information must be reported:

1. Applicant's full name: The name of the individual applying for an Individual Taxpayer Identification Number (ITIN) must be stated.

2. Mailing address: The applicant's current mailing address, where the IRS can send correspondence, should be provided.

3. Foreign address: If the applicant has a foreign address, it should be mentioned.

4. Date of birth: The applicant's date of birth must be included on the form.

5. Phone number: A contact phone number should be given to reach the applicant.

6. Email address: The individual's email address can be included, though it is optional.

7. Filing requirement: The reason why the applicant is required to file a U.S. federal tax return should be specified (e.g., U.S. Resident Alien, Nonresident Alien, etc.).

8. Supporting documentation: The type of original, certified, or notarized identification documents that the applicant is submitting to validate their identity should be listed.

9. Reason for applying: The purpose for which the applicant needs an ITIN must be explained.

10. Passport information: If the applicant possesses a valid passport, its details (passport number, country of issuance, and expiration date) should be provided.

11. U.S. visa number: If the applicant is residing in the U.S. and has a valid visa, the visa number and its expiration date should be mentioned.

12. Foreign tax identification number: If the applicant has a foreign tax identification number, it must be specified.

13. Acceptance agent information (if applicable): If the applicant used an acceptance agent to file the W-7 form, the agent's information should be given.

It is important to note that these requirements may vary based on the specific situation and purpose of obtaining the ITIN. The official instructions accompanying the W-7 form should be followed for accurate completion.

What is the penalty for the late filing of w7 form sample?

The penalty for the late filing of Form W-7, which is used to apply for an Individual Taxpayer Identification Number (ITIN), may vary depending on the specific circumstances. As of 2021, the penalty is $50 per application. However, if the late filing is due to reasonable cause, the penalty may be waived. It is important to note that this information is subject to change, and it is recommended to consult the instructions provided with the form or seek advice from a tax professional for the most accurate and up-to-date penalty information.

How do I complete w7 form online?

pdfFiller has made it simple to fill out and eSign sample filled w7 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit w7 form example online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your w7 form sample to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out w7 form filled sample using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign w 7 form sample and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your w7 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w7 Form Example is not the form you're looking for?Search for another form here.

Keywords relevant to fill w7 form online

Related to form w7 download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.